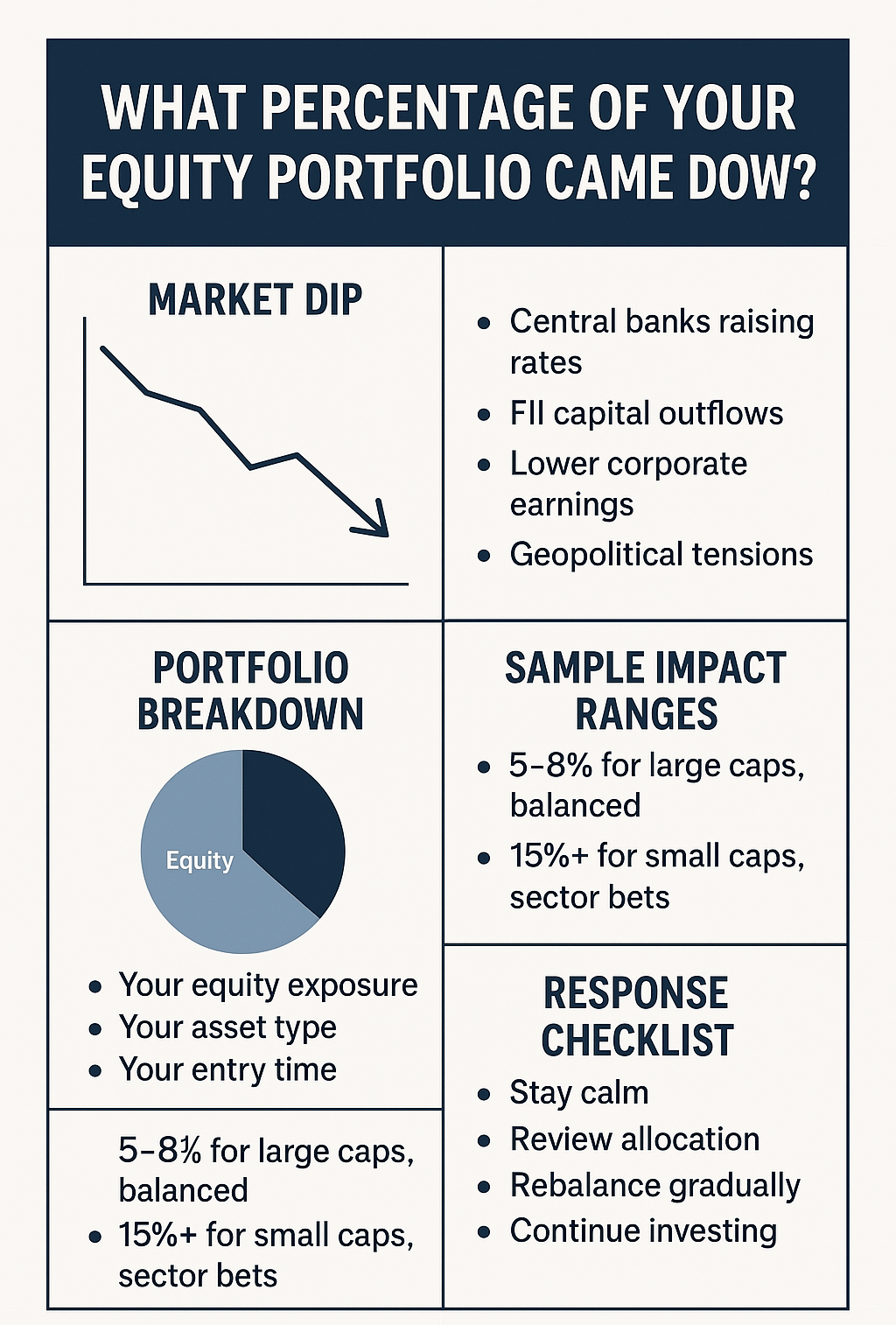

What Percentage of Your Equity Portfolio Came Down in the Recent Market Downtrend?

4/8/20252 min read

What Percentage of Your Equity Portfolio Came Down in the Recent Market Downtrend?

The equity markets in early 2025 have witnessed a notable correction, leaving many investors wondering: “How much value did my portfolio lose?” With benchmark indices down and broader market volatility rising, understanding your portfolio’s performance is critical.

This blog breaks down the reasons behind the recent dip, how to assess the impact on your portfolio, and what steps you should take next — without panic.

Why Did the Market Drop?

Several global and domestic triggers have contributed to this market downtrend:

Central banks increasing interest rates to curb inflation

Concerns about slowing global economic growth

Weak corporate earnings and margin pressures

Profit booking after a strong rally in 2023 and 2024

Rising crude oil prices and geopolitical tensions

FIIs (Foreign Institutional Investors) pulling out capital

Major Indian indices like the Nifty 50 and Sensex have declined by 5–8%, while midcaps and smallcaps have faced sharper corrections — sometimes over 15%.

How Much Did Your Portfolio Fall?

The percentage decline in your portfolio depends on multiple factors:

1. Equity Allocation

Higher the percentage of your portfolio in equities, the greater the likely fall. A 100% equity portfolio is naturally more volatile than a balanced one.

2. Type of Stocks or Funds

Large-cap stocks usually fall less than small- or mid-cap stocks.

Sector concentration (like banking, real estate, or tech) increases risk.

Actively managed funds behave differently than index funds based on their holdings.

3. Entry Point and Timing

Investors who entered near market peaks will see steeper drawdowns, while those with staggered entries via SIPs may experience milder impacts.

What to Avoid During a Market Dip

Don’t panic and exit your investments — this locks in losses

Don’t stop your SIPs — corrections are when SIPs perform best

Don’t try to time the bottom — markets are unpredictable in the short term

Don’t shift everything to cash or fixed deposits out of fear

What to Do Instead

1. Revisit Your Asset Allocation

Ensure your equity-debt ratio aligns with your goals and risk profile. Don’t let greed or fear push you out of balance.

2. Evaluate Portfolio Diversification

If your entire equity portfolio is concentrated in one sector or small-cap stocks, the volatility will be more severe. Diversify across market caps and sectors.

3. Consider Gradual Top-Ups

Downturns offer attractive entry points. If your financials allow, consider adding funds gradually into quality stocks or mutual funds.

4. Stay Goal-Focused

If your investment horizon is long-term (5–10 years), short-term volatility doesn’t affect your ultimate returns. Focus on your goals, not daily price swings.

5. Consult a Professional

Speak to your financial advisor or reach out to trusted firms like One Solution to assess your drawdown and take corrective action if needed.

Final Thoughts

Markets move in cycles. Corrections are healthy and expected. While your equity portfolio might have declined by 5%, 10%, or even 15%, it’s not the end — it’s part of the process.

The most important thing is to stay disciplined, not let emotions drive decisions, and continue to invest smartly. If needed, rebalance with the help of a professional

One Solution offers in-depth portfolio assessments, realignment strategies, and personalized equity planning to help you navigate volatility with clarity and confidence.

Related Blogs:

Don’t Panic Sell – How to Manage Investment Fear

About One Solution

Quick Links

Contact Info

One Solution — Your trusted partner for financial success.

📍 F17, Grand Plaza, Paltan Bazar

Guwahati, Kamrup (M), Assam

India, Pin: 781008

📞 9650072280

© 2025 One Solution. All Rights Reserved.