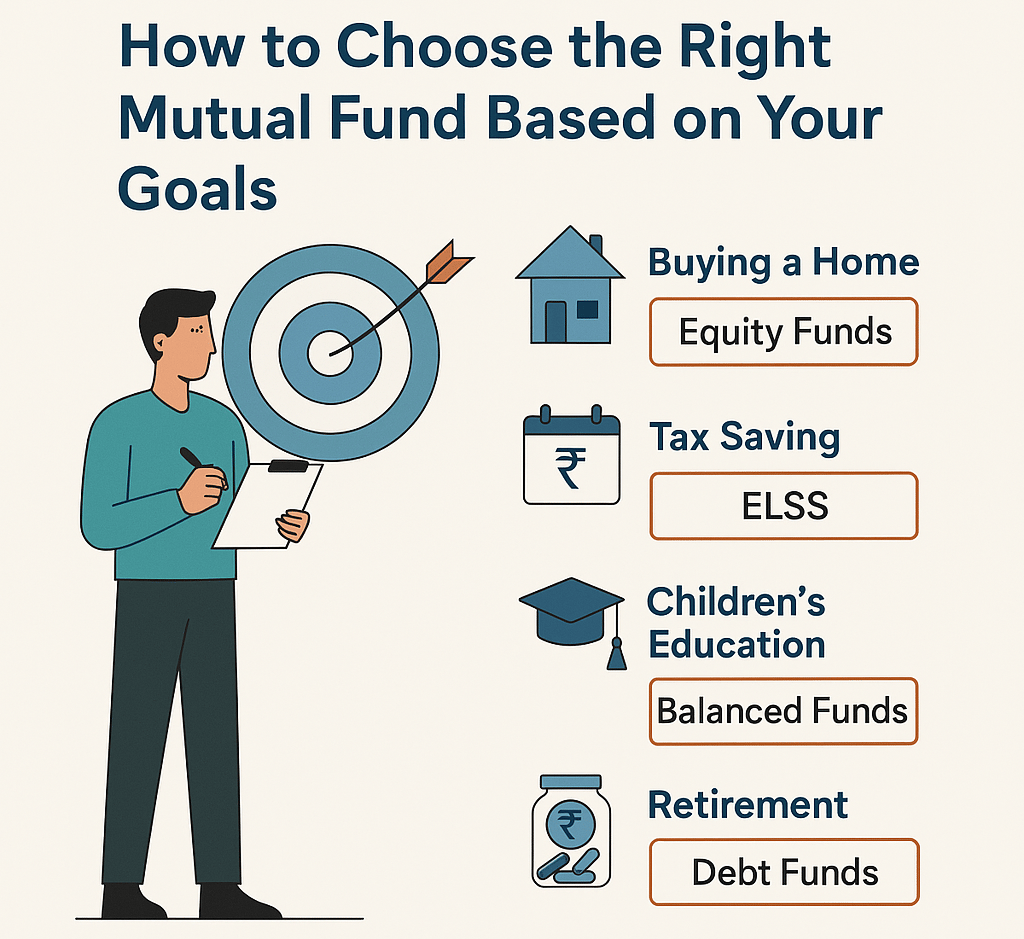

How to Choose the Right Mutual Fund Based on Your Goals (India 2025)

4/3/20252 min read

How to Choose the Right Mutual Fund Based on Your Goals (India 2025)

In India’s ever-evolving investment landscape, selecting the right mutual fund isn’t just about returns—it’s about aligning your investments with your financial goals, time horizon, and risk appetite. Choosing randomly or following trending schemes can backfire. Instead, smart investors in 2025 follow a structured, goal-based selection process.

This blog helps you understand how to choose mutual funds that perfectly match your personal objectives—whether it’s wealth creation, tax saving, child education, or early retirement.

Why Goal-Based Mutual Fund Investing Matters

Every mutual fund serves a different purpose. Some are high-growth equity funds for long-term wealth, while others are low-risk debt funds for short-term needs. If you choose the wrong fund for your goal, you may either:

Take on unnecessary risk

Miss return potential

Face liquidity issues when you need funds

One Solution advises investors to always begin with goal clarity before selecting funds. This ensures discipline, peace of mind, and better long-term outcomes.

Step-by-Step: How to Choose the Right Mutual Fund

1. Define Your Financial Goal

Be specific. Are you:

Building a ₹25 lakh retirement fund in 20 years?

Saving ₹10 lakh for your child’s education in 8 years?

Buying a car in 3 years?

Parking emergency funds?

The clearer your goal, the better the fund match.

2. Determine the Time Horizon

Classify your goal as:

Short-Term (0–3 years) – Choose low-risk debt or liquid funds

Medium-Term (3–5 years) – Consider hybrid or balanced funds

Long-Term (5+ years) – Opt for equity or index funds

3. Assess Your Risk Tolerance

Ask yourself:

Can I handle volatility and market dips?

Would I panic during market crashes?

Am I willing to stay invested long-term?

Based on this, choose:

Low Risk: Debt or Liquid Funds

Moderate Risk: Hybrid or Balanced Advantage Funds

High Risk: Equity, Small Cap, or Sectoral Funds

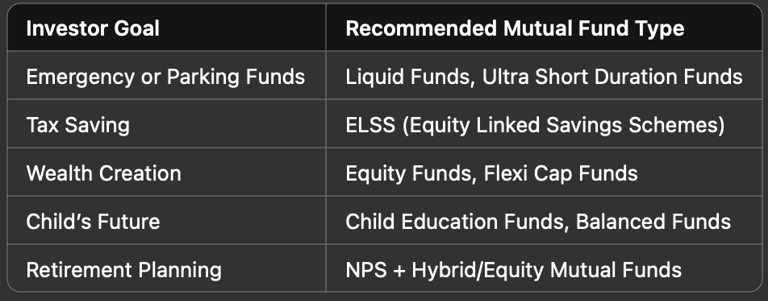

4. Match Fund Type to Your Profile

(Note: One Solution offers curated portfolios for each of these goals with periodic reviews.)

5. Compare Fund Performance & Ratings

Once you shortlist fund types:

Check 3–5 year returns

Compare with benchmark indices (Nifty/Sensex)

Review CRISIL or Morningstar ratings

Check expense ratios

Never select a fund solely based on past 1-year performance. Evaluate consistency and downside protection as well.

6. Start SIP or Lumpsum Based on Cash Flow

SIP: Ideal for salaried investors or regular savers

Lumpsum: Works if you receive bonuses, inheritances, or business income

Platforms like One Solution help you simulate returns, SIP growth, and fund goal-mapping digitally.

Final Thoughts

Choosing the right mutual fund isn’t about chasing the highest return—it’s about matching your investments with your specific financial goals. A goal-based approach ensures that your investments serve a purpose and stay aligned with your life stage.

If you’re unsure which mutual fund fits your profile, One Solution offers complimentary consultations, portfolio planning, and periodic reviews for 360° goal-based investing.

Related Blogs:

What Are Mutual Funds? Complete Guide for Beginners in India (2025)

How to Start SIP in Mutual Funds – Step-by-Step Process (India 2025)

Taxation on Mutual Funds in India – Short-Term vs Long-Term Gains (2025)

About One Solution

Quick Links

Contact Info

One Solution — Your trusted partner for financial success.

📍 F17, Grand Plaza, Paltan Bazar

Guwahati, Kamrup (M), Assam

India, Pin: 781008

📞 9650072280

© 2025 One Solution. All Rights Reserved.