Large Cap vs Mid Cap vs Small Cap Stocks – What to Choose in 2025?

4/1/20252 min read

Large Cap vs Mid Cap vs Small Cap Stocks – Which is Right for Your Portfolio in 2025?

When building a stock market portfolio, understanding the difference between large-cap, mid-cap, and small-cap stocks is crucial. These classifications go beyond company size—they influence your portfolio’s risk, return potential, volatility, and overall strategy.

In this blog, we’ll break down what each market cap segment means, their pros and cons, and how you can allocate your investments smartly based on your financial goals.

What is Market Capitalization?

Market capitalization (or market cap) is the total value of a company’s outstanding shares. It is calculated as:

Market Cap = Current Share Price × Total Number of Shares Outstanding

Market cap helps investors assess a company’s size, stability, and market presence, and it plays a major role in risk profiling and asset allocation.

Classification in India (as per SEBI guidelines):

• Large Cap: Top 100 companies by market capitalization

• Mid Cap: 101st to 250th largest companies

• Small Cap: 251st onwards in terms of market cap

This classification is updated semi-annually and influences mutual fund strategies, index compositions, and investment benchmarks.

🟦 Large Cap Stocks – Stability & Reliability

These are established companies with consistent performance, strong fundamentals, and large investor bases.

Examples: Reliance Industries, TCS, HDFC Bank, Infosys, ITC

Features:

• Lower volatility

• Regular dividends

• Strong brand value and governance

• Ideal for long-term conservative investors

Best for: Beginners, retirement-focused portfolios, and those seeking predictable returns.

🟨 Mid Cap Stocks – Growth Potential with Moderate Risk

These are companies that have crossed the initial growth stage and are on their way to becoming large caps.

Examples: Trent, Apollo Hospitals, Bharat Forge, Dixon Technologies

Features:

• Higher growth opportunities

• Balanced risk-return profile

• Often part of sectoral trends

• Moderate volatility

Best for: Investors with a 3–5 year horizon looking for wealth-building with some risk exposure.

🟥 Small Cap Stocks – High Risk, High Reward

These are emerging businesses with small market share but potential for rapid growth. They are also the most volatile and sensitive to economic cycles.

Examples: BSE Ltd., Fine Organic, Tanla Platforms

Features:

• High return potential

• Greater volatility and liquidity issues

• Prone to market sentiment and speculative trading

• Requires in-depth research

Best for: Aggressive investors, short-term traders, or those seeking alpha in a diversified portfolio.

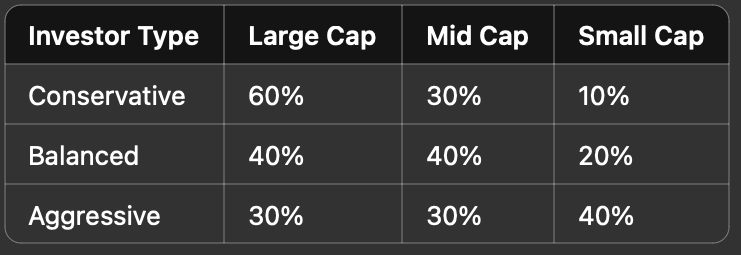

How to Allocate Between Large, Mid & Small Cap Stocks

A suggested allocation based on risk profile:

You can invest through:

• Direct equity

• Mutual funds (Large-cap, Mid-cap, Small-cap funds)

• Multi-cap and flexi-cap funds

• PMS services for customized portfolio structuring

One Solution helps investors diversify correctly with real-time tools, risk profiling, and expert-led allocation strategies.

Related Blogs:

• How to Build a Stock Portfolio in India

• What is a Stock Index – NIFTY, SENSEX Explained

• Common Mistakes Beginners Make in the Stock Market

Final Thoughts

The key to successful investing lies in balancing risk and return. Large-cap stocks offer stability, mid-caps deliver growth, and small-caps can accelerate wealth if timed correctly. Knowing where to place your bets and when to rebalance is what separates good portfolios from great ones.

With One Solution, you get expert-backed diversification, free Demat setup, and intelligent tools to manage your market cap allocations confidently.

About One Solution

Quick Links

Contact Info

One Solution — Your trusted partner for financial success.

📍 F17, Grand Plaza, Paltan Bazar

Guwahati, Kamrup (M), Assam

India, Pin: 781008

📞 9650072280

© 2025 One Solution. All Rights Reserved.