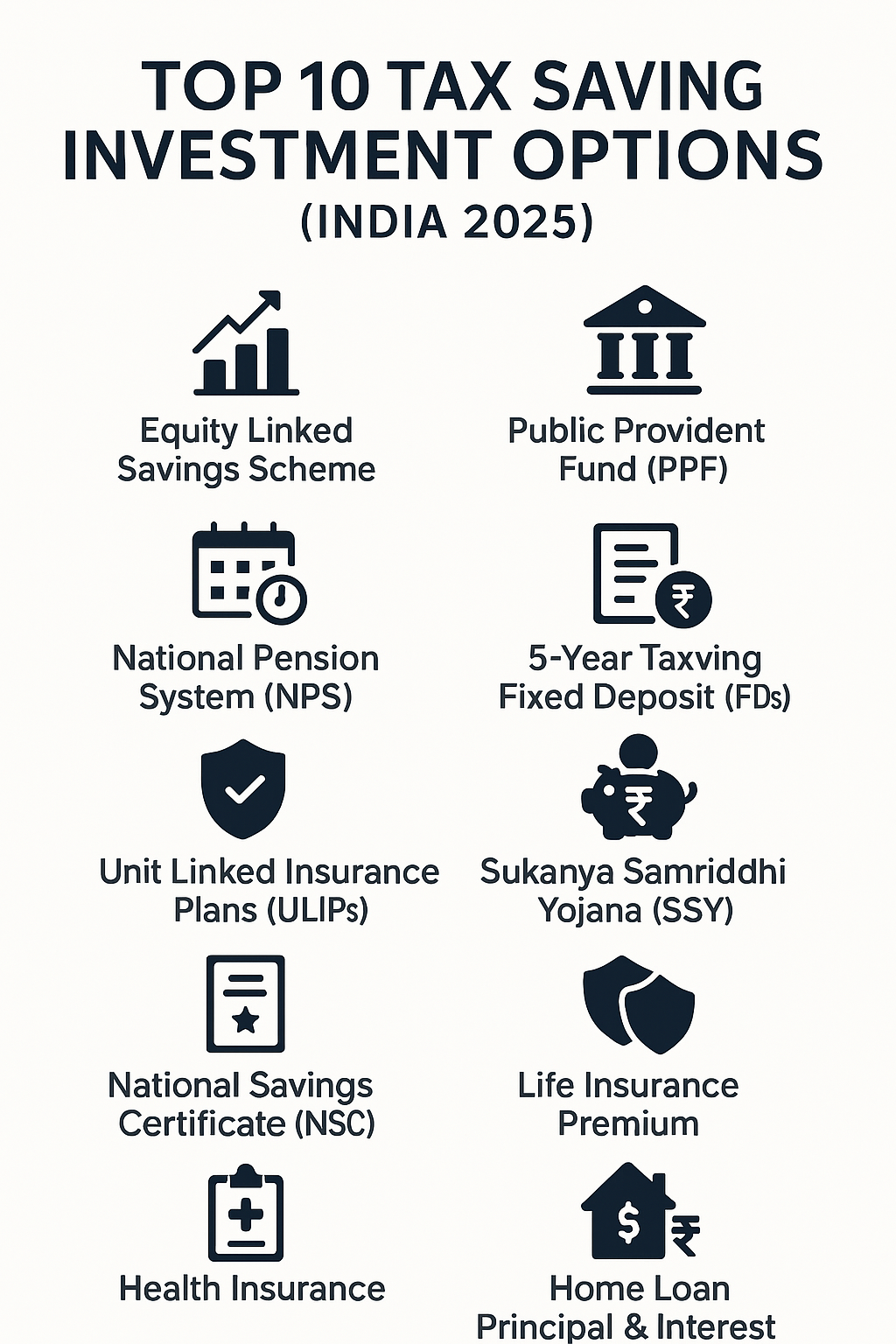

Top 10 Tax Saving Investment Options in India (2025)

4/5/20252 min read

Top 10 Tax Saving Investment Options in India (2025)

As we step into a new financial year, smart tax planning is no longer optional — it’s essential. With rising incomes and evolving tax regulations, Indian taxpayers in 2025 need efficient, reliable, and diversified strategies to save tax while simultaneously growing wealth.

This blog covers the top 10 tax saving investment options in India for the current assessment year, helping you make informed, goal-aligned choices to legally reduce your taxable income.

1. Equity Linked Savings Scheme (ELSS)

Section: 80C

Lock-in: 3 years (shortest under 80C)

Returns: Market-linked (~12–15% CAGR historically)

ELSS is a mutual fund scheme that invests in equities and qualifies for tax deduction up to ₹1.5 lakh. It combines high return potential with the dual benefit of market participation and tax savings.

2. Public Provident Fund (PPF)

Section: 80C

Lock-in: 15 years

Returns: ~7.1% (tax-free)

A long-term, government-backed savings scheme with full tax exemption on principal, interest, and maturity (EEE status). Ideal for conservative investors building a retirement corpus.

3. National Pension System (NPS)

Section: 80CCD(1) + 80CCD(1B)

Lock-in: Till retirement (partial withdrawal allowed)

Returns: ~8–10% (equity + debt)

In addition to ₹1.5 lakh under 80C, NPS offers an extra ₹50,000 deduction under 80CCD(1B), making it one of the most tax-efficient tools. Great for salaried individuals planning retirement.

4. 5-Year Tax Saving Fixed Deposits (FDs)

Section: 80C

Lock-in: 5 years

Returns: ~6.5–7.5% (taxable)

Offered by banks, these FDs qualify for tax deductions. Returns are fixed but taxable, and the lock-in is stricter than mutual funds.

5. Unit Linked Insurance Plans (ULIPs)

Section: 80C

Lock-in: 5 years

Returns: Varies (equity/debt mix)

ULIPs offer life insurance plus investment. Although they’ve evolved with lower charges, returns depend on market-linked funds. Best suited for long-term disciplined investors.

6. Sukanya Samriddhi Yojana (SSY)

Section: 80C

Lock-in: Till girl turns 21

Returns: ~7.6% (tax-free)

A powerful scheme for girl child savings, offering attractive tax-free returns. Only parents/guardians of girls under 10 years can invest.

7. National Savings Certificate (NSC)

Section: 80C

Lock-in: 5 years

Returns: ~7% (interest taxable)

Low-risk government savings bond. Interest is reinvested and counts under 80C, making it suitable for conservative taxpayers.

8. Life Insurance Premium

Section: 80C

Lock-in: Minimum 2 years (policy lapse disqualifies benefits)

Returns: Depends on policy type (term, endowment, ULIP)

Premiums paid for life insurance policies (self/spouse/children) are eligible for deduction. Choose wisely — term plans offer protection; endowments combine savings with low returns.

9. Health Insurance (Mediclaim)

Section: 80D

Deduction Limit:

₹25,000 (self/family)

₹50,000 (senior citizen parents)

Health insurance not only protects your finances during emergencies but also offers deductions on premium payments.

10. Home Loan Principal & Interest

Section:

Principal: 80C

Interest: 24(b) (₹2 lakh limit under self-occupied)

Additional: 80EEA (up to ₹1.5 lakh for affordable housing)

Buying a house? You can claim both principal and interest portions of EMI under different sections for maximum tax relief.

Bonus: Standard Deduction for Salaried Employees

In 2025, a standard deduction of ₹50,000 is allowed under the old regime without proof of investment — a simple way to lower your taxable income.

Final Thoughts

Efficient tax planning is about more than saving money — it’s about aligning your financial goals with smart instruments. Whether you prefer low-risk schemes like PPF and FDs, or growth-oriented options like ELSS and NPS, the right combination can help you save taxes, grow wealth, and plan for your future.

If you’re unsure where to begin, One Solution offers customized tax-saving investment portfolios and expert guidance to help you maximize returns and deductions under the law.

Related Blogs:

ELSS vs PPF vs NPS – Which Is Better for You?

Section 80C Explained – Maximize Your ₹1.5 Lakh Deduction

How to Build a Tax-Efficient Portfolio in 2025

Health Insurance vs Term Insurance – What to Prioritize?

About One Solution

Quick Links

Contact Info

One Solution — Your trusted partner for financial success.

📍 F17, Grand Plaza, Paltan Bazar

Guwahati, Kamrup (M), Assam

India, Pin: 781008

📞 9650072280

© 2025 One Solution. All Rights Reserved.