How to Transfer Shares from Demat Account to Another in India – Complete 2025 Guide

3/29/20252 min read

How to Transfer Shares from One Demat Account to Another – Step-by-Step Process (2025)

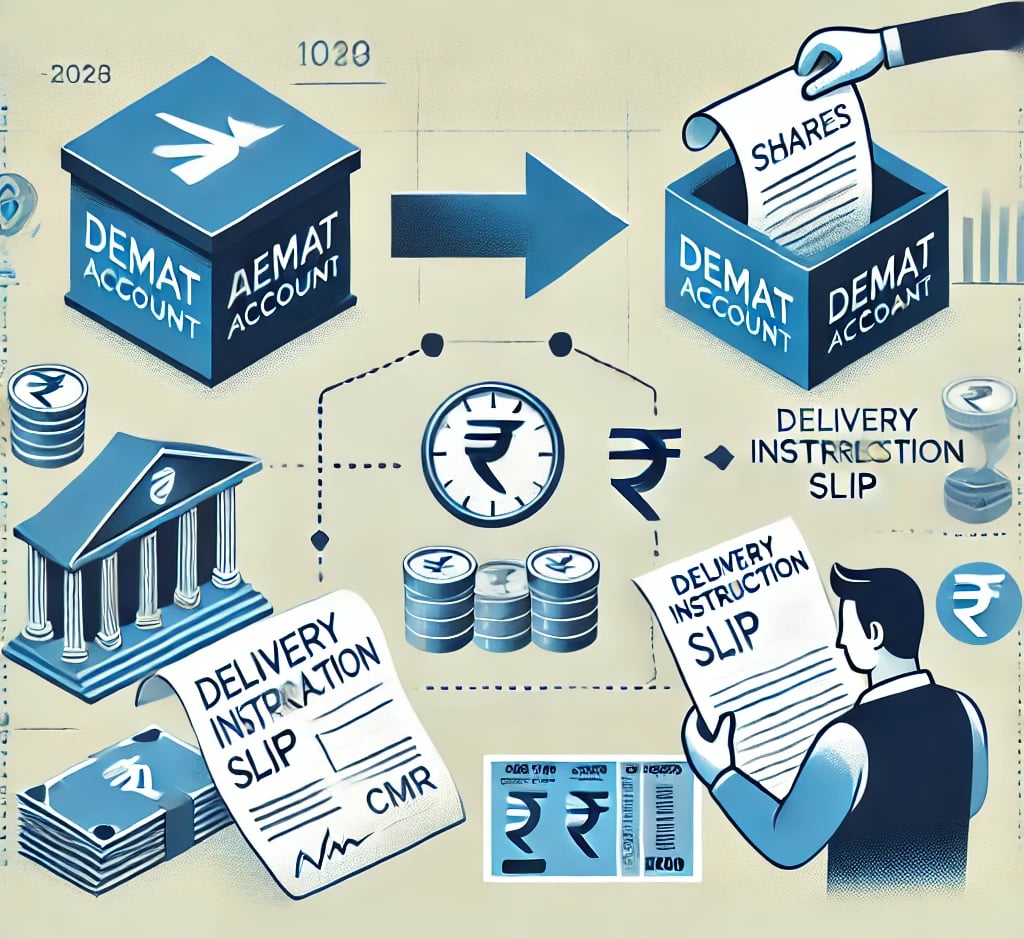

If you’ve recently changed brokers or want to consolidate your investments, you may need to transfer shares from one Demat account to another. This process is known as off-market transfer and requires a few simple steps.

In this professional guide, we explain how to securely move your holdings between Demat accounts, avoid common mistakes, and reduce costs with One Solution.

When Should You Transfer Shares Between Demat Accounts?

• You’re switching brokers for better service or lower charges

• You’ve opened a new Demat account and want to consolidate holdings

• You’re closing an old or inactive account

• You want to move shares between family accounts or joint holders

Types of Demat Share Transfers

1. Intra-depository Transfer

• Both Demat accounts are with the same depository (CDSL to CDSL or NSDL to NSDL)

2. Inter-depository Transfer

• Transfer from CDSL to NSDL or vice versa

• Requires inter-depository transfer form (IDT) and additional processing

Step-by-Step Process to Transfer Shares from One Demat Account to Another

Step 1: Get the CMR of the New Demat Account

Ask your new broker (like One Solution) for your Client Master Report (CMR). This document contains your account details and must be stamped and signed.

Step 2: Fill Out the Delivery Instruction Slip (DIS)

Obtain a DIS booklet from your old broker. Fill in:

• ISIN of the securities (you can find this in your portfolio statement)

• Quantity of shares

• Target Demat account number

• DP ID of the new account

Step 3: Attach Documents and Submit

Include the self-attested CMR copy and filled DIS, then submit to your old broker in person or via courier.

Step 4: Track the Transfer

Once validated, the shares will be transferred within 3 to 5 working days. You will receive alerts from CDSL/NSDL and your brokers.

Important Notes

• You cannot transfer mutual funds or ETFs held in non-Demat form via this process.

• There are no taxes or capital gains triggered for off-market transfers.

• Ensure names and PANs match exactly in both Demat accounts.

• Always take a screenshot or copy of the DIS before submitting.

Charges Involved

Some brokers may charge a nominal fee per ISIN transferred (₹15–₹25 per ISIN).

One Solution offers free transfer support for new account holders migrating portfolios.

Why Transfer to One Solution?

• Free Demat account with low brokerage

• End-to-end transfer support with documentation

• No hidden fees or delays

• Fast CMR access and client-first service

• Transparent communication from start to finish

Final Thoughts

Transferring shares from one Demat account to another is a strategic move—whether for better costs, improved platforms, or cleaner portfolio management. With the right partner, the process is straightforward and secure.

Switch to One Solution today. Transfer your shares and experience a more powerful way to invest.

About One Solution

Quick Links

Contact Info

One Solution — Your trusted partner for financial success.

📍 F17, Grand Plaza, Paltan Bazar

Guwahati, Kamrup (M), Assam

India, Pin: 781008

📞 9650072280

© 2025 One Solution. All Rights Reserved.