Your blog SIP vs Lump Sum – Which Investment Strategy Works Better in 2025?

4/10/20252 min read

SIP vs Lump Sum – Which Investment Strategy Works Better in 2025?

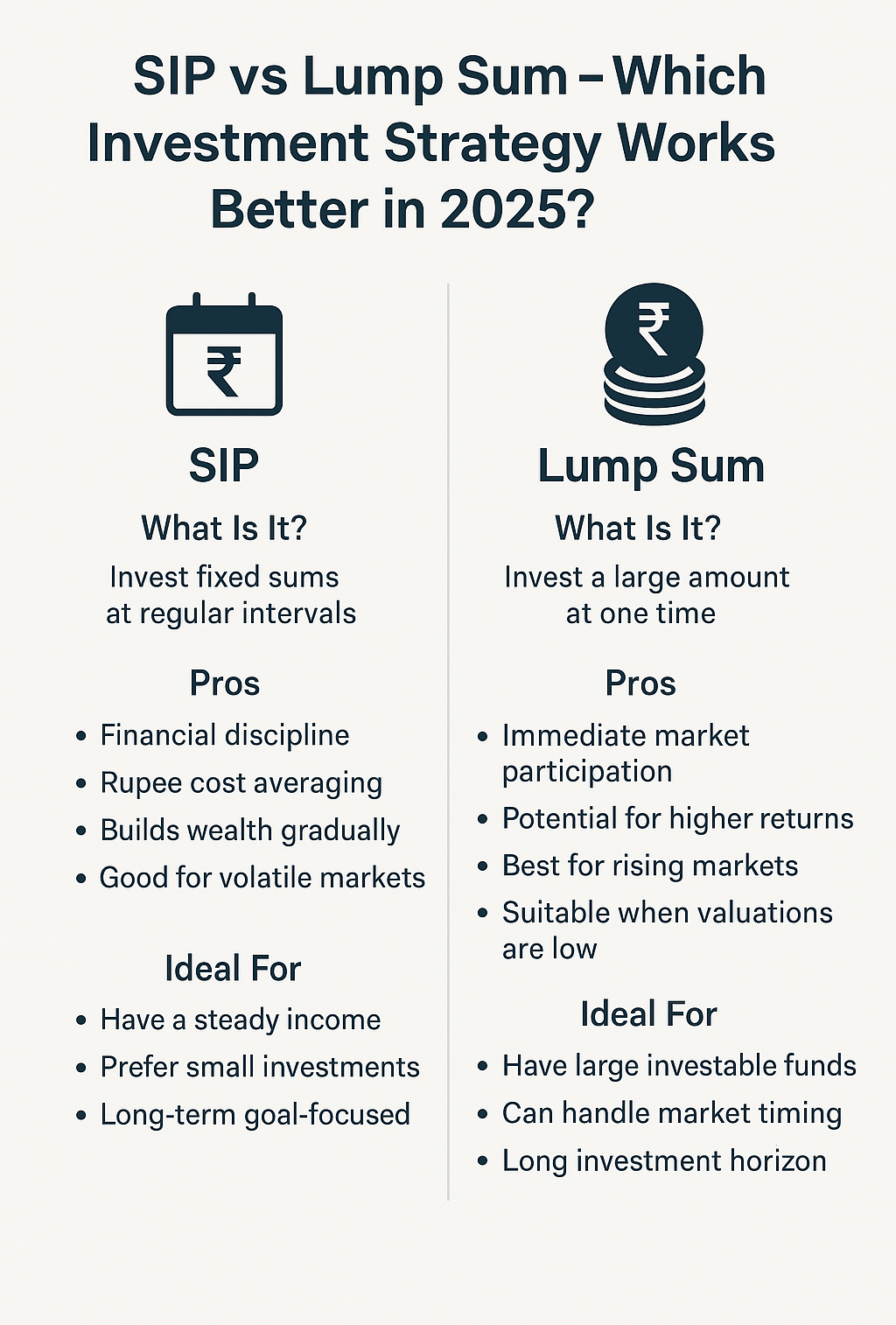

When it comes to investing in mutual funds, two popular approaches dominate investor decisions: Systematic Investment Plans (SIPs) and lump sum investments. Both have their own advantages, risks, and use cases. But which one should you choose in 2025’s dynamic market conditions?

In this blog, we break down SIPs vs lump sum investing, helping you decide the best strategy based on your income, goals, and market behavior.

What Is a SIP?

A Systematic Investment Plan (SIP) allows you to invest a fixed amount of money in mutual funds at regular intervals — typically monthly or quarterly. It’s a disciplined, automated way to invest, regardless of market highs or lows.

Key Benefits of SIP:

Promotes financial discipline

Enables rupee cost averaging during volatile markets

Helps build wealth gradually with small contributions

Ideal for salaried individuals or monthly income earners

Works well for long-term goals like retirement, children’s education, or buying a house

What Is a Lump Sum Investment?

A lump sum investment means putting a large amount of money into mutual funds at once — usually from bonuses, inheritances, or large savings.

Key Benefits of Lump Sum:

Immediate market participation if timed well

Capital grows faster when markets are rising

Suitable for investors with large idle funds

Ideal for long-term goals if invested in the right market phase

Works well when market valuations are attractive

SIP vs Lump Sum – Which Is Better in 2025?

The answer depends on market conditions, your cash flow, and risk appetite.

Choose SIP If:

You want to spread risk across market cycles

You’re worried about investing a large amount at the wrong time

You have a steady income stream and prefer smaller regular commitments

You want to stay emotionally detached from daily market movements

Choose Lump Sum If:

You have a large amount ready to invest

Markets have corrected recently, and valuations are attractive

You’re investing for a long-term goal and can stay invested through cycles

You understand market behavior and are confident in your fund selection

What History Tells Us

Data shows that:

SIPs tend to outperform lump sum investments during volatile or falling markets.

Lump sum performs better in strongly rising markets, especially when entered at the bottom.

Over long tenures (7–10 years or more), the difference narrows, and disciplined investing matters more than timing.

Ideal Approach: Blend Both Strategies

In many cases, a hybrid approach works best. For example:

Invest 30–40% lump sum now (if valuations are fair)

Deploy the rest through SIPs over 6–12 months

Use STPs (Systematic Transfer Plans) if you’re moving from debt to equity gradually

This helps you participate in market growth while managing downside risk.

Final Thoughts

There is no one-size-fits-all answer. SIPs offer emotional comfort and risk spreading, while lump sum investing leverages timing and momentum.

At One Solution, we help you choose the right mix based on your goals, risk profile, and current market conditions — whether you’re investing ₹5,000 per month or ₹5 lakh in one go.

The key isn’t whether you start with SIP or lump sum — it’s that you start, stay consistent, and invest with a plan.

Related Blogs:

How to Stay Invested During Market Corrections

Building a Tax-Efficient Portfolio in 2025

What Percentage of Your Equity Portfolio Came Down?

About One Solution

Quick Links

Contact Info

One Solution — Your trusted partner for financial success.

📍 F17, Grand Plaza, Paltan Bazar

Guwahati, Kamrup (M), Assam

India, Pin: 781008

📞 9650072280

© 2025 One Solution. All Rights Reserved.