Best Performing Mutual Funds in India (2025) You Should Know

4/3/20252 min read

Best Performing Mutual Funds in India (2025) You Should Know

Choosing the right mutual fund can feel overwhelming—but analyzing past performance, fund stability, and consistent returns can guide you toward solid investment decisions. While past returns don’t guarantee future success, top-performing mutual funds often indicate strong management, smart allocation, and sustainable strategies.

In this 2025 roundup, we highlight some of the best-performing mutual funds in India across different categories, based on 3–5 year CAGR, AUM strength, and consistency.

🔍 What Makes a Mutual Fund a “Top Performer”?

A well-performing fund isn’t just about high returns—it also reflects:

Consistent performance across market cycles

Efficient fund management

Strong risk-adjusted returns

High liquidity and investor trust

Reasonable expense ratio

One Solution uses these metrics while recommending mutual fund portfolios to its clients.

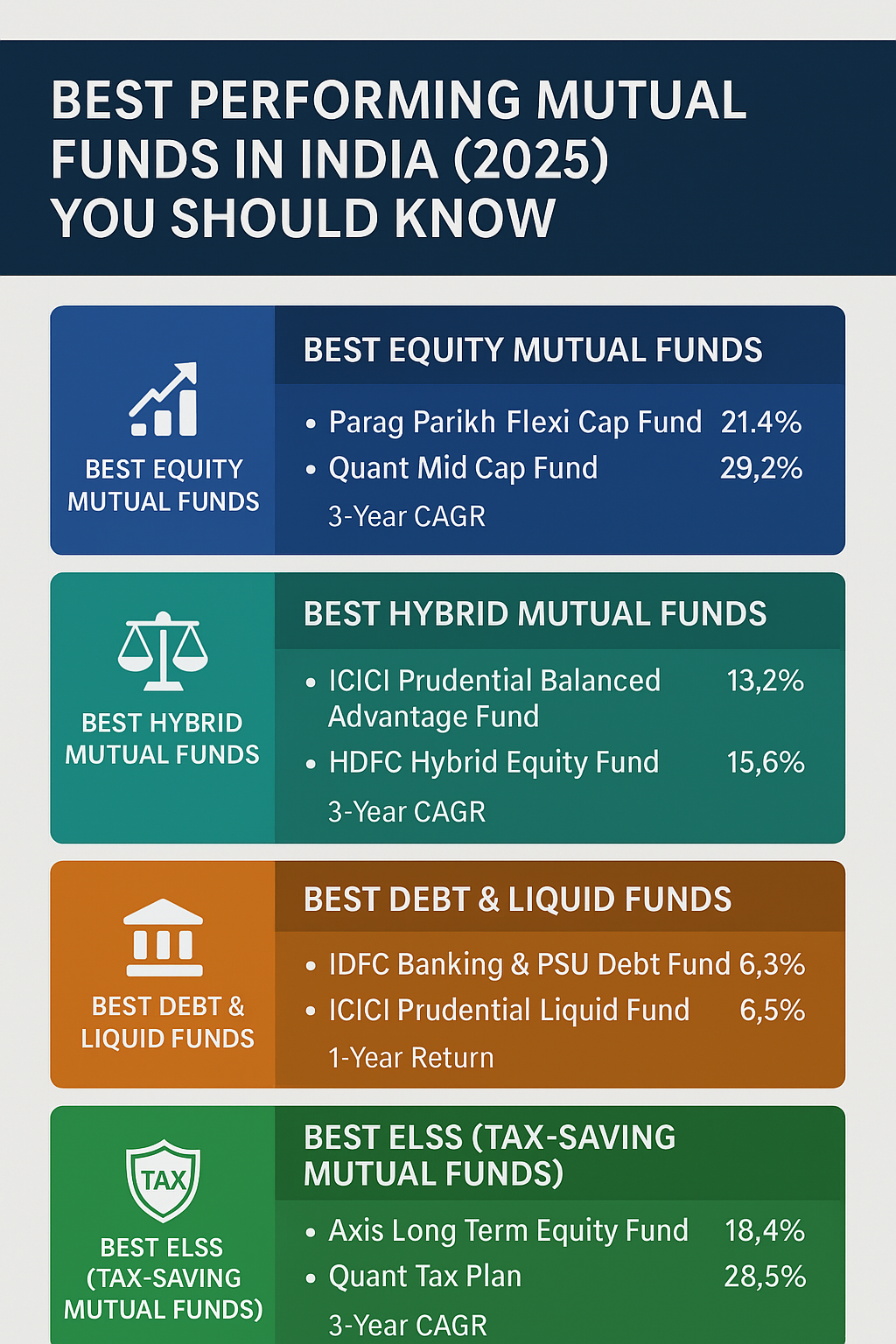

🏆 Best Equity Mutual Funds (2025)

1.Parag Parikh Flexi Cap Fund

3-Year CAGR: ~21.4%

Why it stands out: Global diversification, consistent alpha, low volatility

Ideal for: Long-term equity investors

2.Quant Mid Cap Fund

3-Year CAGR: ~29.2%

Why it stands out: High-growth strategy, aggressive sector rotation

Ideal for: High-risk, high-return seekers

3.SBI Small Cap Fund

3-Year CAGR: ~26.7%

Why it stands out: Deep small-cap exposure with disciplined management

Ideal for: Investors with 5+ year horizon

💼 Best Hybrid Mutual Funds (2025)

1.ICICI Prudential Balanced Advantage Fund

3-Year CAGR: ~13.2%

Why it stands out: Dynamic equity-debt allocation for low volatility

Ideal for: Moderate investors or those transitioning from FDs

2.HDFC Hybrid Equity Fund

3-Year CAGR: ~15.6%

Why it stands out: Higher equity exposure with quality large-cap picks

Ideal for: Balanced-risk investors with 3–5 year outlook

🏦 Best Debt & Liquid Funds (Low-Risk)

1.IDFC Banking & PSU Debt Fund

3-Year CAGR: ~6.8%

Why it stands out: Strong credit quality and low interest rate risk

Ideal for: Parking funds for 1–3 years

2.ICICI Prudential Liquid Fund

1-Year Return: ~6.5%

Why it stands out: Safe liquidity and overnight redemptions

Ideal for: Emergency funds and short-term goals

🌱 Best ELSS (Tax-Saving Mutual Funds)

1.Axis Long Term Equity Fund

3-Year CAGR: ~18.4%

Why it stands out: Strong long-term growth with 80C benefits

Ideal for: Tax-saving investors looking for equity exposure

2.Quant Tax Plan

3-Year CAGR: ~28.5%

Why it stands out: Aggressive style with quick sector shifts

Ideal for: Risk-tolerant investors focused on returns + tax benefits

📊 How to Pick From These?

Match fund style with your financial goal and risk tolerance

Don’t chase returns alone—check consistency, fund size, and volatility

Use SIP mode to average costs and avoid timing risk

Consult with expert advisors like One Solution for portfolio fit and rebalancing

Final Thoughts

These top-performing mutual funds have consistently delivered value across market phases. However, performance must always be aligned with your personal financial goals, investment horizon, and risk capacity.

Want a portfolio with high-performing funds tailored to your needs? Reach out to One Solution for a free risk assessment and custom investment roadmap.

Related Blogs:

About One Solution

Quick Links

Contact Info

One Solution — Your trusted partner for financial success.

📍 F17, Grand Plaza, Paltan Bazar

Guwahati, Kamrup (M), Assam

India, Pin: 781008

📞 9650072280

© 2025 One Solution. All Rights Reserved.