Section 80C Explained – How to Maximize Your ₹1.5 Lakh Tax Deduction (India 2025)

4/6/20252 min read

Section 80C Explained – How to Maximize Your ₹1.5 Lakh Tax Deduction (India 2025)

Section 80C of the Income Tax Act is one of the most widely used tools for reducing taxable income in India. It allows individuals to claim deductions up to ₹1.5 lakh per financial year by investing or spending in eligible instruments.

However, to truly benefit, you need to not only utilize the full limit but also choose the right mix of instruments based on returns, lock-in period, liquidity, and financial goals.

This blog breaks down Section 80C in 2025, the best ways to use it, and strategies to extract maximum value from your tax-saving investments.

What Is Section 80C?

Section 80C provides a deduction of up to ₹1,50,000 from your gross total income if you invest or spend in specified avenues. This reduces your taxable income, effectively lowering the amount of tax payable.

It is available to:

Salaried employees

Self-employed professionals

Hindu Undivided Families (HUFs)

Applicable under the old tax regime only.

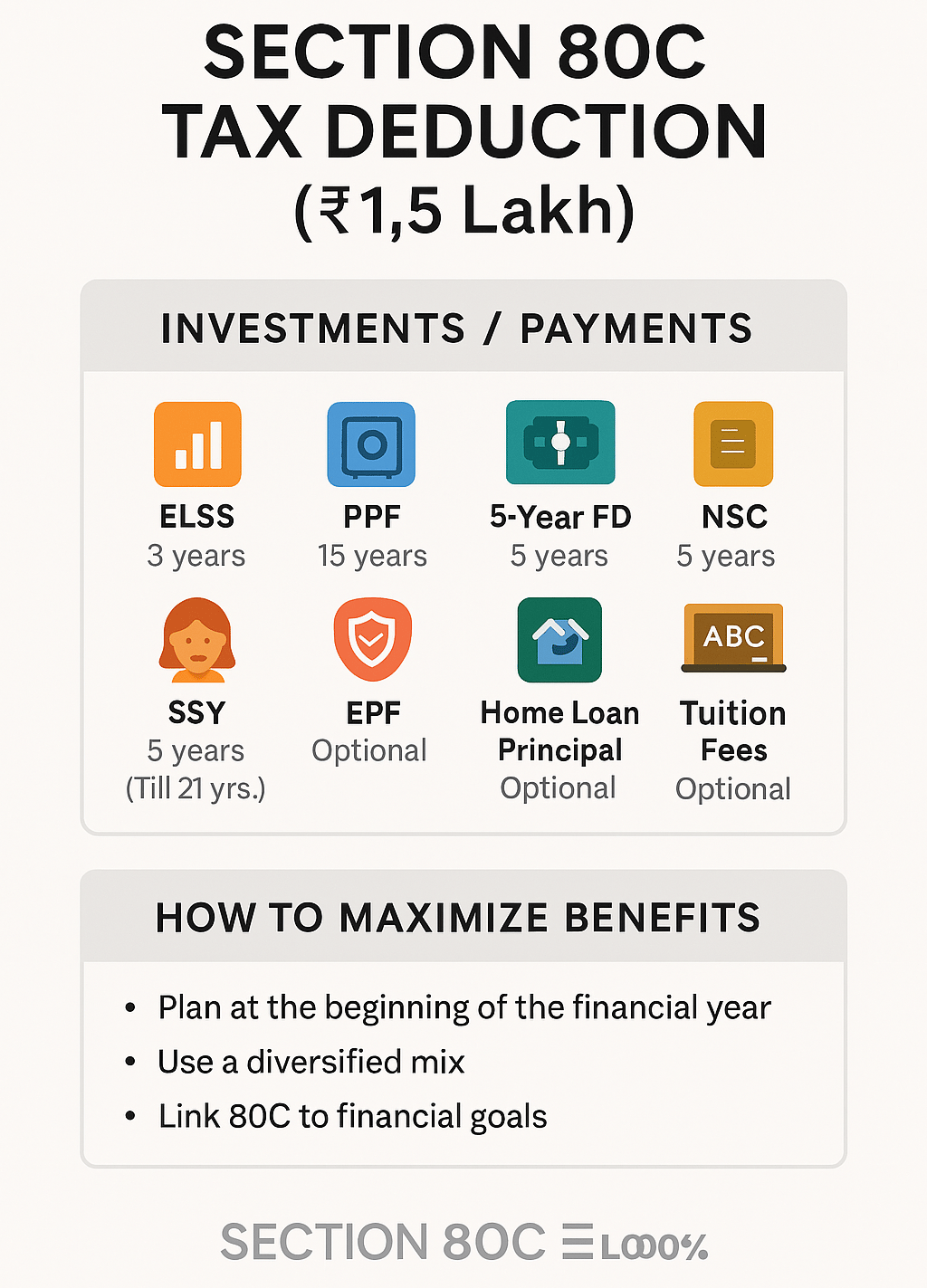

Eligible Investments and Payments Under Section 80C (2025)

Here’s a detailed list of eligible instruments:

ELSS (Equity Linked Savings Schemes)

Lock-in: 3 years

Market-linked returns (high growth potential)

PPF (Public Provident Fund)

Lock-in: 15 years

Government-backed, tax-free returns

5-Year Tax Saving Fixed Deposit

Lock-in: 5 years

Fixed returns; interest is taxable

National Savings Certificate (NSC)

Lock-in: 5 years

Interest reinvested and qualifies for deduction

Sukanya Samriddhi Yojana (SSY)

Lock-in: Till girl child turns 21

Best for parents of daughters

Life Insurance Premiums

Policy must be in name of self, spouse, or child

Minimum 5-year lock-in

EPF (Employee Provident Fund)

Automatically deducted for salaried employees

Employer contribution not eligible

Principal Repayment of Home Loan

Includes stamp duty and registration charges (only in year of purchase)

Children’s Tuition Fees

For full-time education at a registered Indian institution

Limited to 2 children

Senior Citizens Savings Scheme (SCSS)

Lock-in: 5 years

Available for age 60+

How to Maximize Your 80C Benefits

1. Plan at the Beginning of the Financial Year

Start early to avoid last-minute, low-return investments just to meet the ₹1.5 lakh threshold.

2. Use a Diversified Mix

Don’t put everything into one instrument. For example:

₹50,000 in ELSS for growth

₹60,000 in PPF for safety

₹40,000 in life insurance premium

3. Link 80C to Financial Goals

Choose instruments that align with your objectives:

ELSS for wealth creation

PPF for retirement

SSY for girl child education

EPF for long-term salaried planning

4. Factor In Mandatory Contributions

If EPF or tuition fees are being paid, subtract them from your ₹1.5 lakh limit before choosing additional options.

What’s Not Covered Under 80C

Medical insurance (covered under 80D)

Education loan interest (covered under 80E)

Donations (covered under 80G)

Final Thoughts

Section 80C is not just about saving tax — it’s about building future-ready wealth while legally reducing tax liability. When used wisely, it becomes a cornerstone of personal finance management for every taxpayer.

At One Solution, we help you structure a tax plan that not only saves ₹1.5 lakh under 80C, but also aligns your savings with your life goals. Get help with investment selection, proofs, tracking, and more — all under one expert platform.

Related Blogs:

How to Build a Tax-Efficient Portfolio in 2025

About One Solution

Quick Links

Contact Info

One Solution — Your trusted partner for financial success.

📍 F17, Grand Plaza, Paltan Bazar

Guwahati, Kamrup (M), Assam

India, Pin: 781008

📞 9650072280

© 2025 One Solution. All Rights Reserved.