How to Build a Tax-Efficient Portfolio in India (2025)

4/6/20252 min read

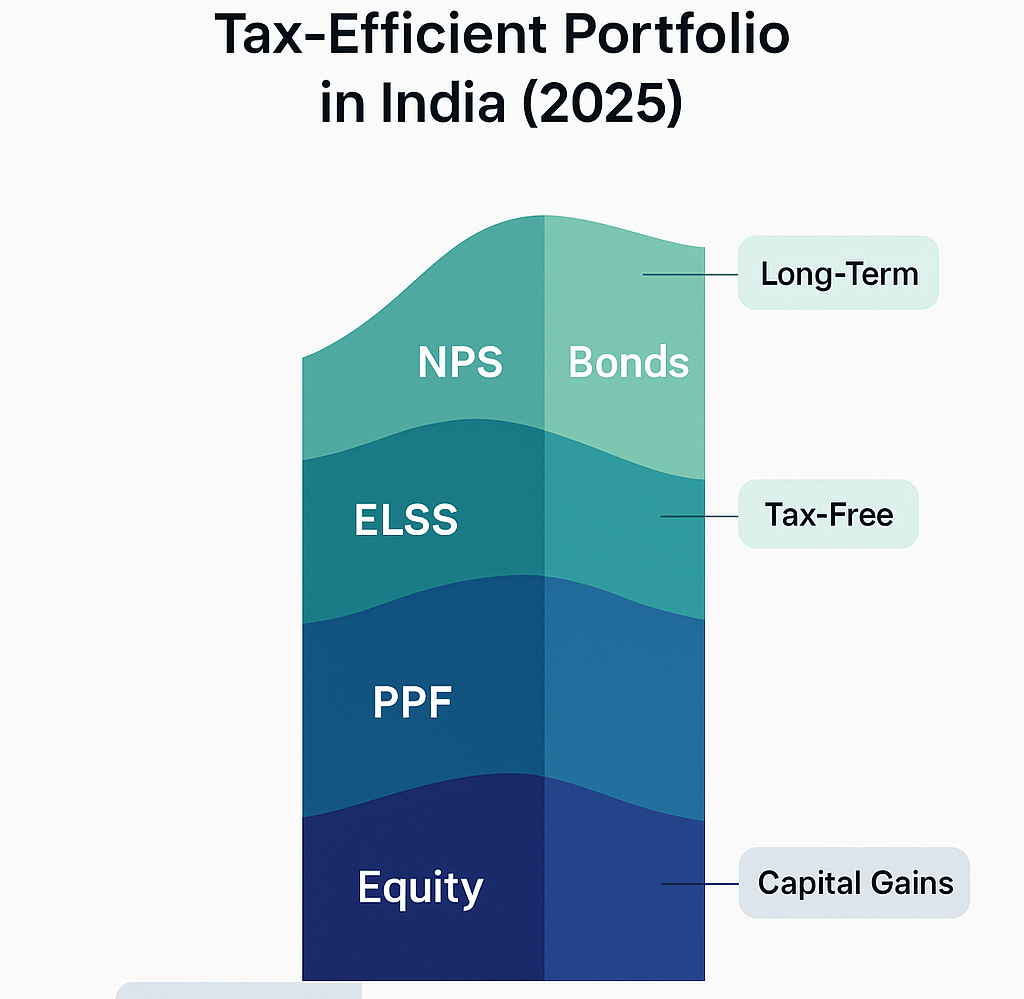

How to Build a Tax-Efficient Portfolio in India (2025)

Investing isn’t just about returns — it’s also about what you keep after taxes. In India’s 2025 financial landscape, tax-efficient investing is critical to preserving and compounding wealth. Whether you’re salaried, self-employed, or a high net-worth individual, understanding how to build a tax-efficient portfolio can help you maximize gains while legally minimizing tax outgo.

This guide walks you through how to plan, allocate, and optimize your investments to reduce tax liability across asset classes.

What Is a Tax-Efficient Portfolio?

A tax-efficient portfolio is a mix of investments that are strategically chosen not just for their growth potential, but also for their tax treatment — including exemptions, deductions, deferments, or indexation benefits.

It’s not about avoiding taxes — it’s about legally reducing them while aligning with long-term financial goals.

Step-by-Step Guide to Building a Tax-Efficient Portfolio

1. Identify Your Tax Bracket and Regime

The first step is choosing between:

Old Tax Regime – Allows deductions under 80C, 80D, HRA, LTA, etc.

New Tax Regime – Lower tax slabs with no major deductions.

If you’re claiming tax-saving investments, the old regime is usually better. Match your investment planning with your regime.

2. Use Full ₹1.5 Lakh Limit Under Section 80C

Include:

ELSS – High growth + tax deduction

PPF – Safe, long-term, tax-free returns

Life Insurance – Protection + 80C benefit

Home Loan Principal or Tuition Fees

A well-diversified combination ensures both safety and returns.

3. Add an Extra ₹50,000 via NPS (Section 80CCD(1B))

By investing in the National Pension System, you get an additional deduction of ₹50,000 beyond 80C, making your total tax-saving limit ₹2 lakh. NPS also supports retirement planning.

4. Use Tax-Free Returns Where Available

Opt for products that offer full exemption on returns:

PPF – EEE status

Sukanya Samriddhi Yojana – For girl child savings

Maturity from Life Insurance (under Section 10(10D))

These instruments provide tax-free maturity, enhancing effective returns.

5. Use Capital Gains Management

Understand how various assets are taxed:

Equity mutual funds & stocks: LTCG over ₹1 lakh taxed at 10%

Debt mutual funds: Taxed as per slab (no indexation from 2023)

Real estate: LTCG after 2 years, taxed at 20% with indexation

Gold: 20% LTCG with indexation (after 3 years)

Use options like indexation, harvesting losses, or holding longer to reduce capital gains tax.

6. Invest Through Tax-Efficient Vehicles

Index Funds – Lower turnover, hence lower taxable distributions

ETFs – Cost-efficient and less tax leakage

REITs with dividend taxation – Know the tax impact before choosing

Avoid high-churn funds or frequent redemptions that trigger short-term capital gains.

7. Utilize Tax-Friendly Income Options

If you need regular income:

Dividend-paying stocks or mutual funds

Tax-free bonds (like PSU bonds or municipal bonds)

Senior Citizen Savings Scheme (for eligible investors)

These help generate cash flow with limited tax burden.

8. Rebalance Your Portfolio with Tax in Mind

Don’t rebalance frequently unless necessary. Each sale may trigger tax events. Use fresh investment to realign allocation when possible.

Final Thoughts

Building a tax-efficient portfolio is not about using one tool — it’s about combining the right investments with the right tax strategies. From choosing the right regime to balancing growth, income, and deduction benefits, every choice matters.

At One Solution, we help you build personalized, tax-optimized portfolios using a mix of equity, debt, ELSS, NPS, PPF, and other instruments — tailored to your income, goals, and tax structure.

Related Blogs:

About One Solution

Quick Links

Contact Info

One Solution — Your trusted partner for financial success.

📍 F17, Grand Plaza, Paltan Bazar

Guwahati, Kamrup (M), Assam

India, Pin: 781008

📞 9650072280

© 2025 One Solution. All Rights Reserved.